Fundbox is an excellent lender for small businesses. You can prequalify to get a loan on the net, which only needs a soft credit history Check out. It only will take a couple of minutes to discover what types of loans you qualify for.

To get a CDC/SBA 504 loan, your business will have to fill at the least fifty one% from the business constructing you’re financing and satisfy the community CDC’s job creation and economic advancement targets.

Organization listings on this website page Usually do not imply endorsement. We don't attribute all companies available on the market. Other than as expressly established forth in our Conditions of Use, all representations and warranties with regards to the data introduced on this website page are disclaimed. The knowledge, which include pricing, which seems on This page is matter to change at any time

Increase your receivables course of action, help get rid of the headache affiliated with amassing payments, and Strengthen income movement.

It’s most effective should you’re an established business with unique, time-delicate desires, because eligibility is more challenging and new businesses may not be approved. The loan quantities cap out at $350,000, but as a consequence of their pace they’re great for those who’re qualified and need less cash for an urgent or specialized niche require.

By invoice factoring, a business can use its invoices to borrow the quantity its clients can pay Down the road: The lender receives the Bill and its long term payment, when the business gets quick-phrase funding.

This enables us to connect each business with the suitable funding choice. We hope to connect together with your business before long and anticipate receiving you around the street to success.

We understand that just about every business is unique and deserves economical guidance that aligns with its vision. Our business loan solutions are designed to gas your ambitions, delivering flexible and competitive financing alternatives

Our workforce of International Exchange Advisors possess the encounter and know-how that will help you control your business throughout borders even though conducting productive, Value-efficient Global transactions.

Greater than 800 lenders, Local community improvement corporations, and micro-lending institutions are approved to challenge SBA loans. Underneath the SBA’s 7(a) loan guaranty software, the lender supplies the loan and also the SBA claims to pay the lender a part of the loan In case the borrower defaults.

Any time you’re Completely ready to connect with a skilled SBA loan officer, use our type to speedily match with SBA loan plans determined by your particular circumstances.

Fundera is a popular solution simply because you can make an more info application for numerous loans via a solitary software. It's not only a timesaver, but this means you can find less credit score checks on the account, which often can negatively effect your credit rating rating.

Specifications vary by lender, but corporations normally qualify for business loans according to size, money, own and corporation credit profiles, and just how long they’ve been functioning. They acquire financing as lump sums or credit traces, based on the type of loan and lender.

If you can pinpoint your preferences precisely on new equipment or facilities, having said that, the SBA 504 loan is your best guess. It’s similar to the conventional 7(A), with loans of approximately $twenty million and extended repayment phrases, but it’s built specifically for large, stationary expending. Consider the 504 If the business is in need of new land, new services, or expanded operations.

Scott Baio Then & Now!

Scott Baio Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Morgan Fairchild Then & Now!

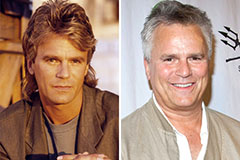

Morgan Fairchild Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!